How Do You Calculate 3 Times The Rent

Treneri

Apr 07, 2025 · 6 min read

Table of Contents

How to Calculate 3 Times the Rent: A Comprehensive Guide for Renters and Landlords

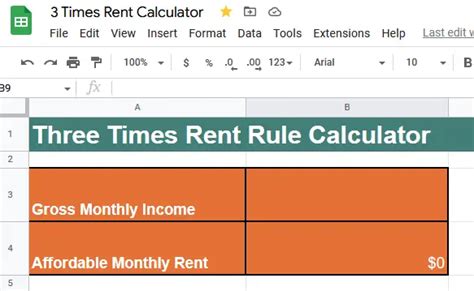

Finding the right rental property can be a stressful process, especially when navigating financial requirements. One common hurdle is the "3 times the rent" rule, a frequently used benchmark by landlords to assess a prospective tenant's financial stability. This article provides a comprehensive guide on how to calculate 3 times the rent, addressing common questions and scenarios faced by both renters and landlords.

Understanding the "3 Times the Rent" Rule

The "3 times the rent" rule is a simple yet effective screening tool used by many landlords. It dictates that a potential tenant's gross monthly income should be at least three times the monthly rent amount. This rule serves as a preliminary assessment of a tenant's ability to consistently meet their rental obligations. It helps landlords gauge whether a tenant's income is sufficient to cover rent, even in the face of unexpected expenses or fluctuations in income.

Why is this rule so prevalent? Landlords are looking to minimize risk. By requiring a tenant to earn three times the rent, they aim to ensure that rent payments won't significantly strain the tenant's budget. This lowers the likelihood of late or missed payments, reducing potential financial losses for the landlord.

Calculating Your Gross Monthly Income

Accurately calculating your gross monthly income is crucial for determining if you meet the 3 times the rent requirement. Gross monthly income refers to your total income before taxes and other deductions. This includes:

- Salary: This is your regular paycheck before taxes and other deductions.

- Bonuses: Include any regular bonuses you receive, such as annual performance bonuses or holiday bonuses. However, avoid including one-time bonuses that are not recurring.

- Overtime Pay: If your income regularly includes overtime pay, factor it into your calculation. However, avoid using exceptionally high overtime amounts that might not be consistent.

- Self-Employment Income: If you're self-employed, calculate your average monthly net profit after business expenses. Provide documentation such as tax returns to prove your income.

- Investment Income: Interest from savings accounts, dividends from stocks, and rental income can all be included, provided they are consistent.

- Alimony and Child Support: These forms of income are generally considered reliable and can be factored into your calculation. Be prepared to provide documentation to support your claim.

- Other Sources of Income: Any other regular income streams should be included. Be transparent and provide supporting documents.

Important Note: Do not include income that is not consistent or verifiable. Landlords need to be confident that your income will remain stable. Inflating your income to meet the requirement is unethical and could lead to rejection.

Calculating 3 Times the Rent: A Step-by-Step Guide

Once you have accurately calculated your gross monthly income, the next step is to calculate three times the rent:

Step 1: Determine the monthly rent. This is the amount you will be paying each month for the rental property.

Step 2: Multiply the monthly rent by three. This will give you the minimum gross monthly income required to meet the 3 times the rent rule.

Step 3: Compare your gross monthly income to the result from Step 2. If your gross monthly income is equal to or greater than the result, you generally meet the income requirement.

Example:

Let's say the monthly rent for an apartment is $1,500.

Step 1: Monthly rent = $1,500

Step 2: 3 x $1,500 = $4,500

Step 3: If your gross monthly income is $4,500 or more, you likely meet the 3 times the rent requirement.

Dealing with Variations and Exceptions

While the 3 times the rent rule is common, it's not universally applied. Landlords may adjust this rule based on various factors, including:

- Credit Score: A strong credit score might allow you to qualify even if you don't meet the strict 3 times the rent rule. A high credit score demonstrates responsible financial behavior.

- Co-Signer: Having a co-signer with a strong income and credit history can significantly increase your chances of approval, even if your income alone doesn't meet the requirement.

- Rental History: A solid rental history showcasing consistent on-time payments can also sway a landlord's decision.

- Type of Property: The type of property (e.g., luxury apartment, studio apartment) can affect the income requirements. Luxury apartments might have higher income requirements.

- Location: Properties in high-demand areas might have stricter income requirements.

- Landlord's Policies: Individual landlords have varying policies and may consider other factors beyond the 3 times the rent rule.

What if Your Income Doesn't Meet the Requirement?

If your income falls short of the 3 times the rent requirement, don't lose hope. Here are some options:

- Seek a co-signer: A financially stable co-signer can significantly increase your chances of approval.

- Improve your credit score: Working to improve your credit score demonstrates financial responsibility and might make you a more attractive tenant.

- Look for less expensive rentals: Consider properties with lower rent amounts that align better with your income.

- Explore alternative housing options: Consider shared housing, roommates, or other affordable alternatives.

- Negotiate with the landlord: Explain your circumstances and see if the landlord is willing to make an exception based on your overall financial stability.

Calculating 3 Times the Rent for Landlords: Tips and Best Practices

Landlords also need to understand how to accurately calculate 3 times the rent for prospective tenants. Here's what you should consider:

- Verify income: Don't just take the tenant's word for it. Request pay stubs, tax returns, or bank statements to verify their income.

- Consider all income sources: Don't overlook additional income sources such as alimony, child support, or investment income.

- Use a standardized calculation: Establish a clear and consistent method for calculating 3 times the rent to ensure fair and unbiased screening.

- Document everything: Keep detailed records of the income verification process and your decision-making process.

- Be aware of fair housing laws: Avoid discriminatory practices based on race, religion, national origin, or other protected characteristics.

- Consider other factors: While the 3 times the rent rule is a useful guideline, don't solely rely on it. Consider credit score, rental history, and overall financial stability.

Beyond the Numbers: Assessing Overall Financial Stability

The 3 times the rent rule provides a starting point, but it shouldn't be the only factor determining tenancy. Landlords should also assess:

- Credit History: Check the tenant's credit report for any signs of financial instability, such as late payments or bankruptcies.

- Rental History: Review the tenant's past rental history to assess their reliability as a tenant.

- Employment History: A stable employment history suggests a consistent income stream.

- References: Check references from previous landlords or employers to get a holistic picture of the tenant's reliability.

Conclusion: A Balanced Approach to Rental Screening

The "3 times the rent" rule is a valuable tool in the rental screening process, providing a quick assessment of a tenant's potential to meet their financial obligations. However, it’s crucial to remember that it’s just one piece of the puzzle. Landlords and renters should adopt a balanced approach, considering various factors beyond the numerical calculation to ensure a successful and mutually beneficial rental agreement. Open communication, thorough documentation, and a fair assessment process are essential for both parties. By understanding the nuances of this rule and employing a holistic approach to financial assessment, both landlords and renters can navigate the rental market more effectively.

Latest Posts

Latest Posts

-

What Grade Is A 19 Out Of 25

Apr 08, 2025

-

How Many Balloons To Lift A Pound

Apr 08, 2025

-

How Many Months Is 66 Days

Apr 08, 2025

-

How Many Miles In 12000 Feet

Apr 08, 2025

-

How Much Concrete To Fill 8x8x16 Block Per

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Do You Calculate 3 Times The Rent . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.