How To Calculate The Contribution Margin

Treneri

Apr 06, 2025 · 6 min read

Table of Contents

How to Calculate the Contribution Margin: A Comprehensive Guide

Understanding your contribution margin is crucial for the financial health of any business. It's a key performance indicator (KPI) that reveals how effectively your company is using its resources to generate profit. This comprehensive guide will walk you through everything you need to know about calculating and interpreting the contribution margin, empowering you to make data-driven decisions for improved profitability.

What is the Contribution Margin?

The contribution margin represents the portion of revenue that remains after deducting variable costs. In simpler terms, it's the amount of money each sale contributes towards covering fixed costs and generating profit. A higher contribution margin indicates that your business is more efficient at converting sales into profit.

Understanding Variable vs. Fixed Costs:

Before diving into the calculation, it's critical to differentiate between variable and fixed costs:

-

Variable Costs: These costs directly correlate with the production volume. As production increases, so do variable costs. Examples include direct materials, direct labor (for certain manufacturing processes), sales commissions, and packaging costs. These costs change in direct proportion to your output.

-

Fixed Costs: These remain relatively constant regardless of production volume within a specific relevant range. Examples include rent, salaries, insurance, and depreciation. Even if you produce nothing, these costs still exist.

How to Calculate the Contribution Margin: Three Key Methods

There are three primary ways to calculate the contribution margin: as a total, per unit, and as a ratio.

1. Calculating the Total Contribution Margin

The formula for calculating the total contribution margin is straightforward:

Total Contribution Margin = Total Revenue - Total Variable Costs

Let's illustrate this with an example:

Imagine a company that generated $100,000 in revenue during a given period. Their total variable costs during the same period were $60,000.

Total Contribution Margin = $100,000 - $60,000 = $40,000

This means the company's total contribution margin is $40,000. This amount is available to cover fixed costs and contribute to profit.

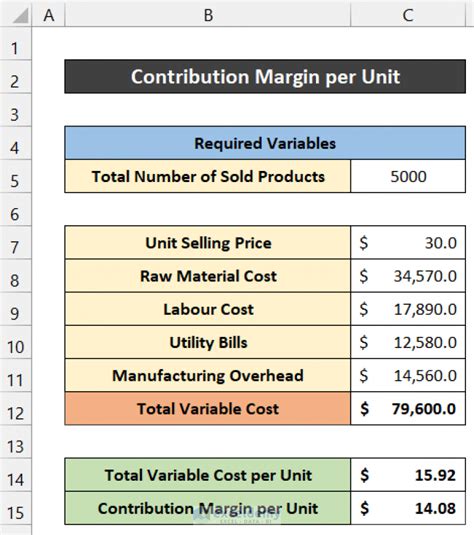

2. Calculating the Contribution Margin per Unit

Understanding the contribution margin per unit provides insights into the profitability of each individual product or service. The formula is:

Contribution Margin per Unit = Selling Price per Unit - Variable Cost per Unit

Using the same example company, let's assume they sold 10,000 units. Their average selling price per unit is $10, and the average variable cost per unit is $6.

Contribution Margin per Unit = $10 - $6 = $4

This means each unit sold contributes $4 towards covering fixed costs and generating profit. This metric is particularly useful for pricing strategies and product mix analysis.

3. Calculating the Contribution Margin Ratio

The contribution margin ratio expresses the contribution margin as a percentage of revenue. This offers a standardized measure for comparison across different periods or products. The formula is:

Contribution Margin Ratio = (Total Revenue - Total Variable Costs) / Total Revenue * 100%

Alternatively, and often more practically:

Contribution Margin Ratio = (Contribution Margin per Unit / Selling Price per Unit) * 100%

Using our example:

Contribution Margin Ratio = ($40,000 / $100,000) * 100% = 40%

This indicates that for every dollar of revenue generated, $0.40 contributes towards covering fixed costs and generating profit. A higher ratio generally signifies better profitability.

Interpreting the Contribution Margin: What Does it Tell You?

The contribution margin provides valuable insights into various aspects of your business:

-

Profitability Assessment: A high contribution margin suggests strong profitability potential. It indicates that a significant portion of revenue is available to cover fixed costs and contribute to net profit.

-

Pricing Decisions: Analyzing the contribution margin helps determine optimal pricing strategies. By understanding the relationship between selling price, variable costs, and contribution margin, you can make informed pricing decisions to maximize profit.

-

Product Mix Analysis: For businesses selling multiple products, the contribution margin analysis assists in identifying the most profitable product lines. This allows for resource allocation towards high-margin products and potential phasing out of low-margin items.

-

Break-Even Analysis: The contribution margin is a critical component in break-even analysis. The break-even point is where total revenue equals total costs (fixed and variable). Understanding the contribution margin helps determine the sales volume needed to reach the break-even point. The formula is:

Break-Even Point (in units) = Fixed Costs / Contribution Margin per Unit

Break-Even Point (in sales dollars) = Fixed Costs / Contribution Margin Ratio

-

Sales Forecasting: By projecting sales revenue and variable costs, you can forecast your contribution margin and estimate potential profits. This assists in strategic planning and resource allocation.

-

Cost Control: Monitoring the contribution margin helps identify areas for cost reduction. By analyzing variable costs and their impact on the contribution margin, businesses can implement strategies to minimize expenses and improve profitability.

Advanced Applications and Considerations

The contribution margin is not just a simple calculation; it's a powerful tool with numerous advanced applications:

-

Segmented Contribution Margin Analysis: Analyze the contribution margin for different product lines, geographic regions, or customer segments to gain a deeper understanding of profitability drivers. This granular level of analysis can identify areas of strength and weakness within the business.

-

Cost-Volume-Profit (CVP) Analysis: The contribution margin is central to CVP analysis, a technique used to understand the relationship between costs, volume, and profit. CVP analysis helps predict profits at various sales levels and make informed decisions on pricing, production volume, and cost management.

-

Marginal Costing: Marginal costing uses the contribution margin concept extensively. Instead of assigning fixed costs to each unit, marginal costing focuses on the contribution margin to aid in decision-making, particularly regarding short-term pricing decisions and production levels.

Potential Pitfalls and Limitations

While the contribution margin is a valuable tool, it's crucial to be aware of its limitations:

-

Accurate Cost Classification: Properly classifying costs as variable or fixed is critical for accurate contribution margin calculations. Misclassifying costs can lead to misleading results. Some costs can exhibit characteristics of both variable and fixed costs (semi-variable or mixed costs). These require careful analysis and may need to be separated into their variable and fixed components using methods like the high-low method or regression analysis.

-

Relevance Range: Fixed costs remain constant only within a specific relevant range of production. Beyond this range, fixed costs may increase (e.g., needing to rent additional space), thus affecting the contribution margin calculations.

-

Ignoring Non-Monetary Factors: The contribution margin primarily focuses on financial aspects. It may not fully capture factors like customer satisfaction, brand reputation, or long-term strategic goals. These non-financial considerations are crucial for overall business success and shouldn't be entirely overlooked.

Conclusion: Mastering the Contribution Margin for Business Success

The contribution margin is an indispensable tool for any business, regardless of its size or industry. By understanding how to calculate and interpret the contribution margin, businesses can gain valuable insights into their profitability, make data-driven decisions, and ultimately achieve greater success. Regularly monitoring and analyzing the contribution margin, coupled with a thorough understanding of its strengths and limitations, empowers businesses to optimize their operations and maximize profits in the long run. Remember, accurate cost allocation and consistent application of the calculations are paramount to getting meaningful and reliable results from your contribution margin analysis.

Latest Posts

Latest Posts

-

10 Ounces Of Water To Cups

Apr 08, 2025

-

How Many Ounces Are In 2 2 Pounds

Apr 08, 2025

-

How To Calculate Sustainable Growth Rate

Apr 08, 2025

-

1500 Sq Ft To Sq Meters

Apr 08, 2025

-

How Many Months Is 51 Days

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate The Contribution Margin . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.